what is open end credit agreement

Any agreement to open an account under an open end consumer credit plan under which extensions of credit are secured by a consumers principal dwelling which is entered into after the end of the 5-month period beginning on the date on which the regulations prescribed under subsection a become final. What Is an Open Ended Promissory Note.

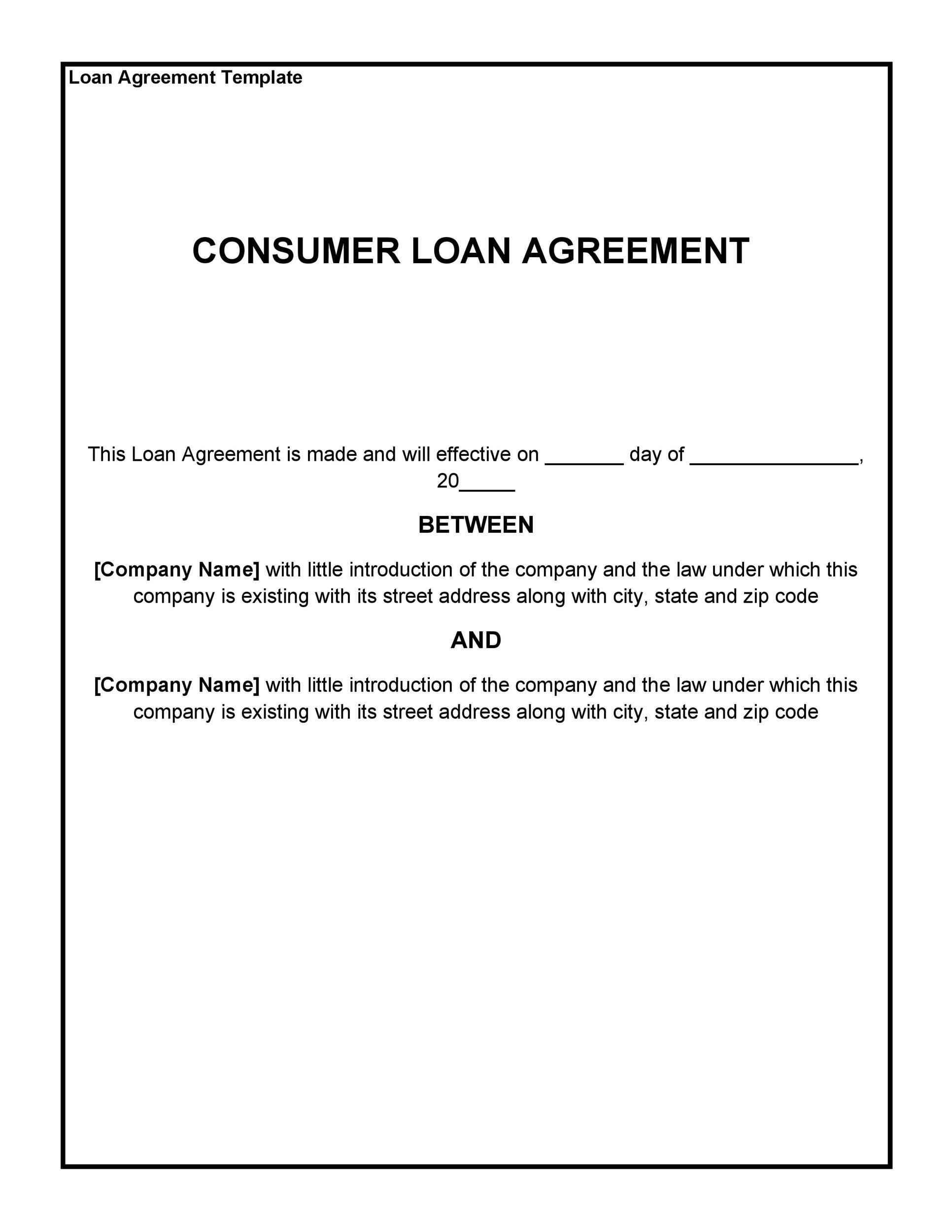

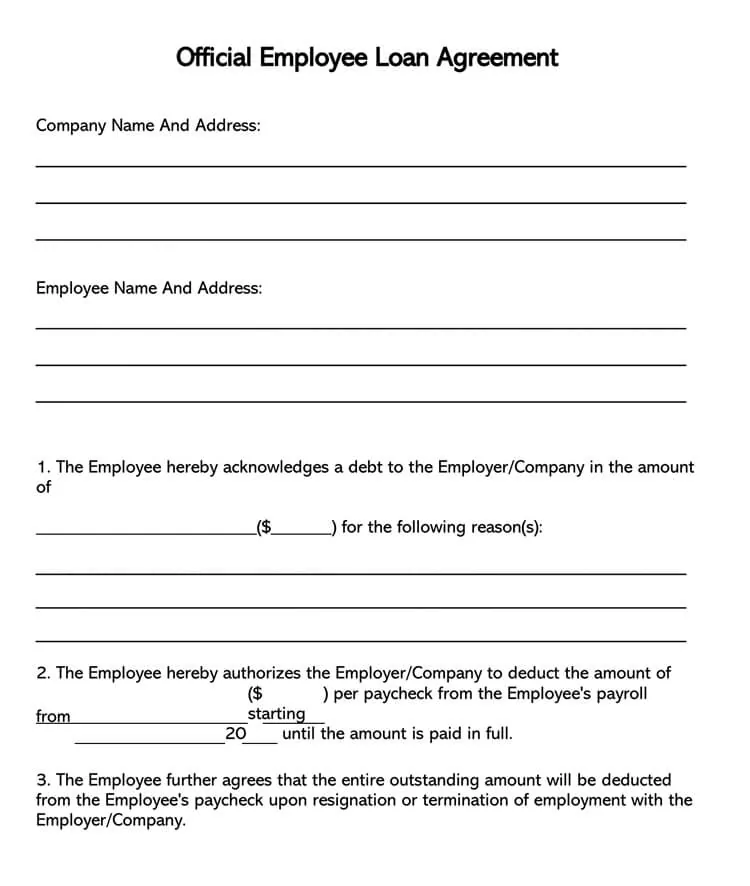

38 Free Loan Agreement Templates Forms Word Pdf

This type of credit has a limit that cant be exceeded without penalty charges.

. No provisions of a marital property agreement a unilateral statement under Section 76659 or a court decree under Section 76670 adversely affects the interest of the creditor unless the creditor prior to the time credit is granted is furnished a copy of the agreement statement or decree or has knowledge of the adverse provision when the. Type of open-end credit agreement that offers a choice of paying in full each month or spreading payments over a period of time. A line of credit is a type of open-end credit.

A promissory note is a contract to repay borrowed money. One master loan agreement is signed when the multi-featured plan is first established. With The Right TRAC GM Financials open-ended lease product you have the freedom to determine your monthly payment by setting the term and residual that works best for you and your business.

If approved you will be able to borrow additional funds on the same loan amount up to a limit established by the lender. An open-end mortgage allows you to access your home equity and use the funds as necessary. When you lease a car youll usually be offered a closed-end lease.

Terms in this set 9 Open end credit. Keep in mind your borrowing limit depends on your homes value and the amount of your first mortgage. On closed-end credit youll have a fixed payment that allows you to pay off your balance with a set amount each month which may make budgeting easier.

Closed end credit cannot be altered once the agreement is signed. Under a line of credit agreement the consumer takes out a loan that allows payment for expenses using special checks or increasingly a plastic. File a complaint with the Better.

In the case of a credit card account under an open end consumer credit plan under which a late fee or charge may be imposed due to the failure of the obligor to make payment on or before the due date for such payment the periodic statement required under subsection b with respect to the account shall include in a conspicuous location on the. The monthly payments for closed-end credit are typically higher than the monthly payments for open-end credit even for the same borrowed amount. Unlike a credit card which is an excellent example of an open-end loan closed-end loans do not allow borrowers to continually access new funds when they have paid back a portion of the original borrowed amount.

In a closed-end lease the leasing company takes on the risk of any additional depreciation. Model clause b is for use in connection with other open-end credit plans. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage.

A secured credit card and home equity line. Open end credit allows you to put money in and take money out as through a cash withdrawal or by making a charge. Multiple sub-accounts with both open-end and closed-end credit features are added under the one master loan.

A pre-approved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. You also have the ability to customize your new or used vehicle by adding the necessary upfit equipment. See interpretation of this section in Supplement I.

However with a revolving line of credit as soon as the. A line of credit is a type of open-end credit. Both closed end and open end credit are perfectly designed for different.

The pre-approved amount will be set out in the agreement between the lender and the borrower. The blended approach is not an MFOEL plan. A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral.

An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. In an open-end lease more common in business leasing the person or company leasing the vehicle takes on that risk but leasing terms may be more flexible. Existence of a plan.

According to the University of Minnesota Extension the four types of promissory notes are the simple note demand note installment note and open-ended note. In a Nutshell. Advantages of Open Credit.

This definition describes the characteristics of open-end credit for which the applicable disclosure and other rules are contained in Subpart B as distinct from closed-end credit. Once the funds have been transferred to the borrower they must be paid back entirely to satisfy the terms of the borrowing agreement and conclude. Sample G-24 includes two model clauses for use in complying with 102616h4.

In other words an open-end mortgage allows the borrower to increase the amount. Generally it is uneconomical and expensive for a borrower to borrow money repeatedly every two or three months and repay it fully. Applies to open-end and closed-end credit transactions.

The finance charge is assessed as of the date credit is extended. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed. The _____ of a loan is the amount of money borrowed.

Model clause a is for use in connection with credit card accounts under an open-end not home-secured consumer credit plan. It is more accurately described as a multi-featured lending plan and consists of the following features. Open-end credit is consumer credit that is extended under a plan and meets all 3 criteria set forth in the definition.

In a closed-end lease the leasing company takes on the risk of any additional depreciation. And with several lease-end options The Right.

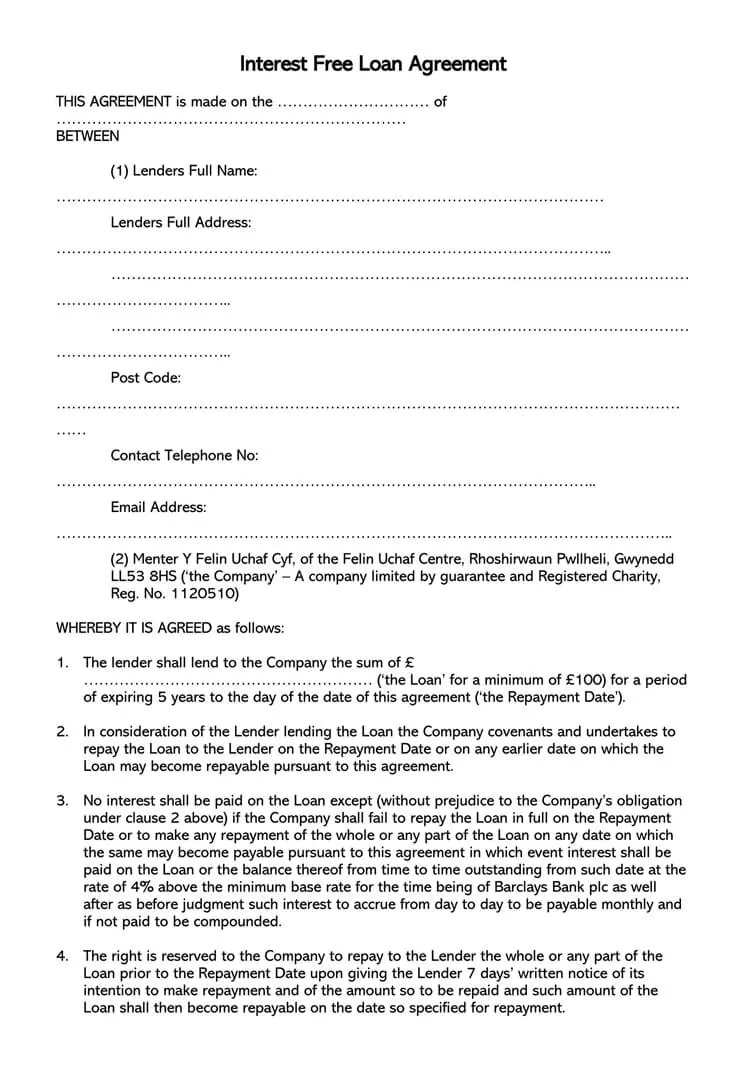

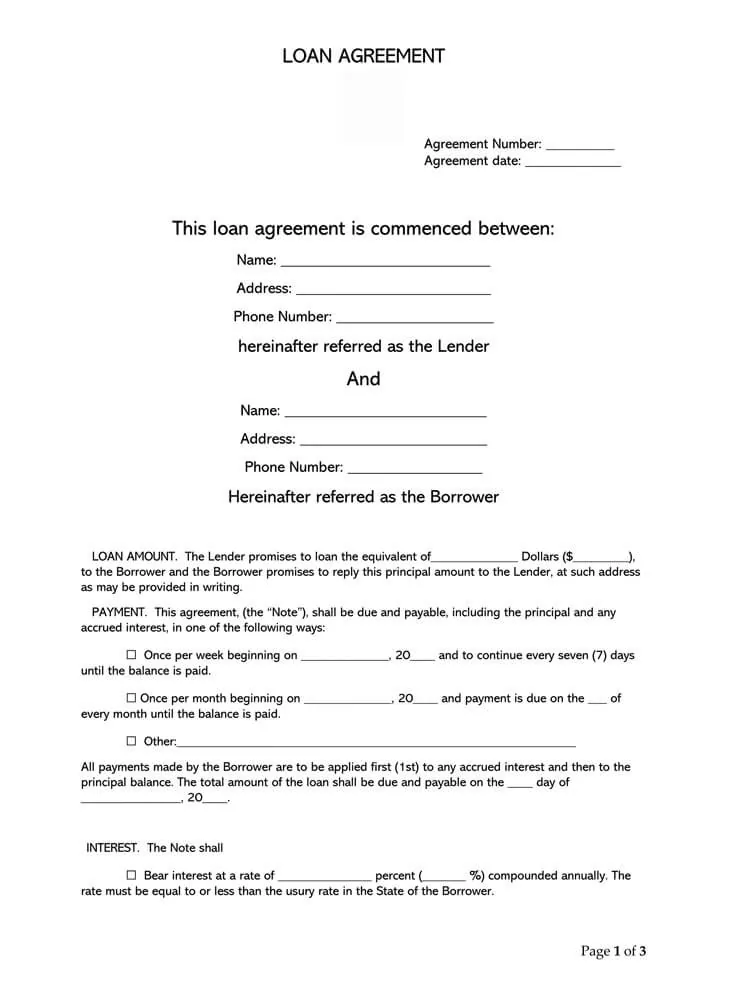

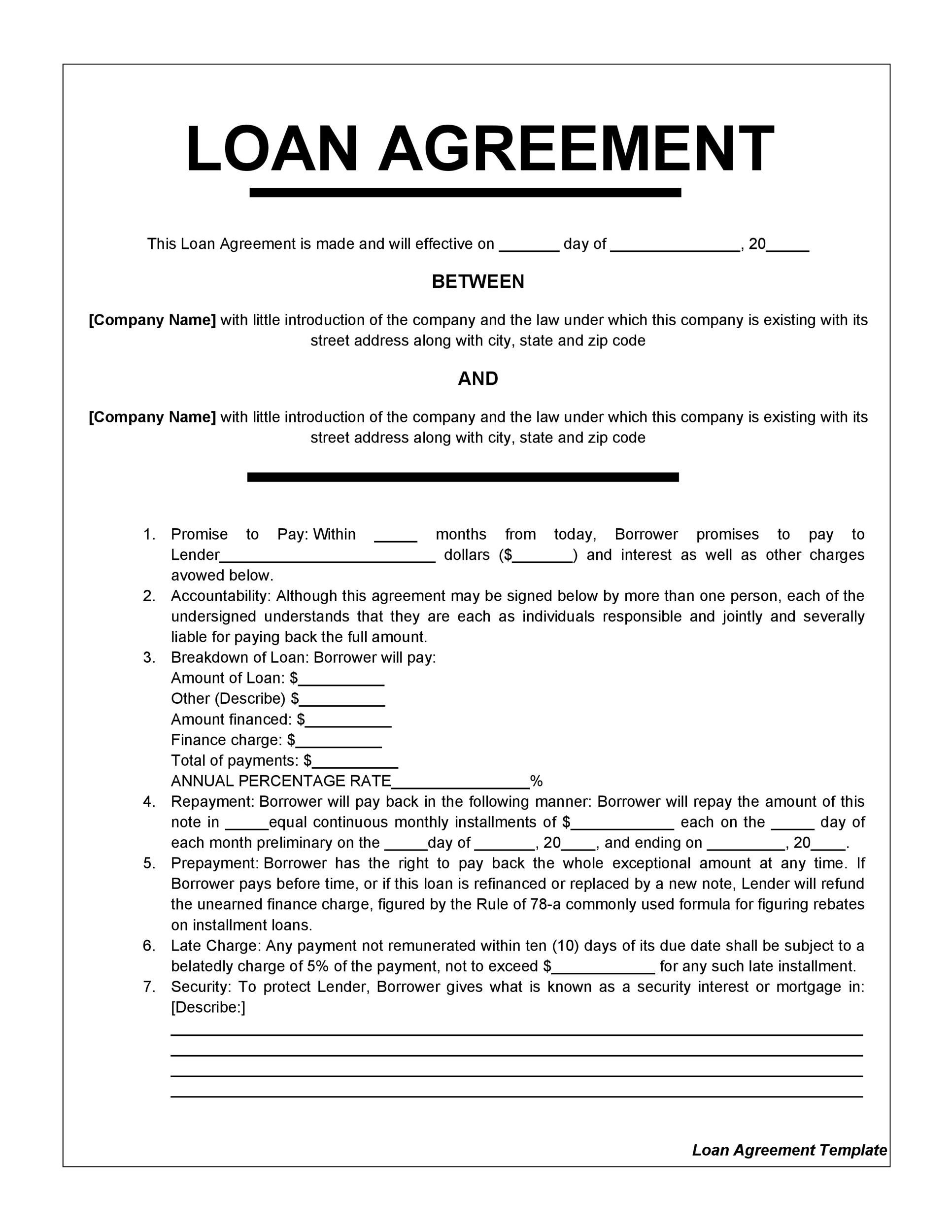

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

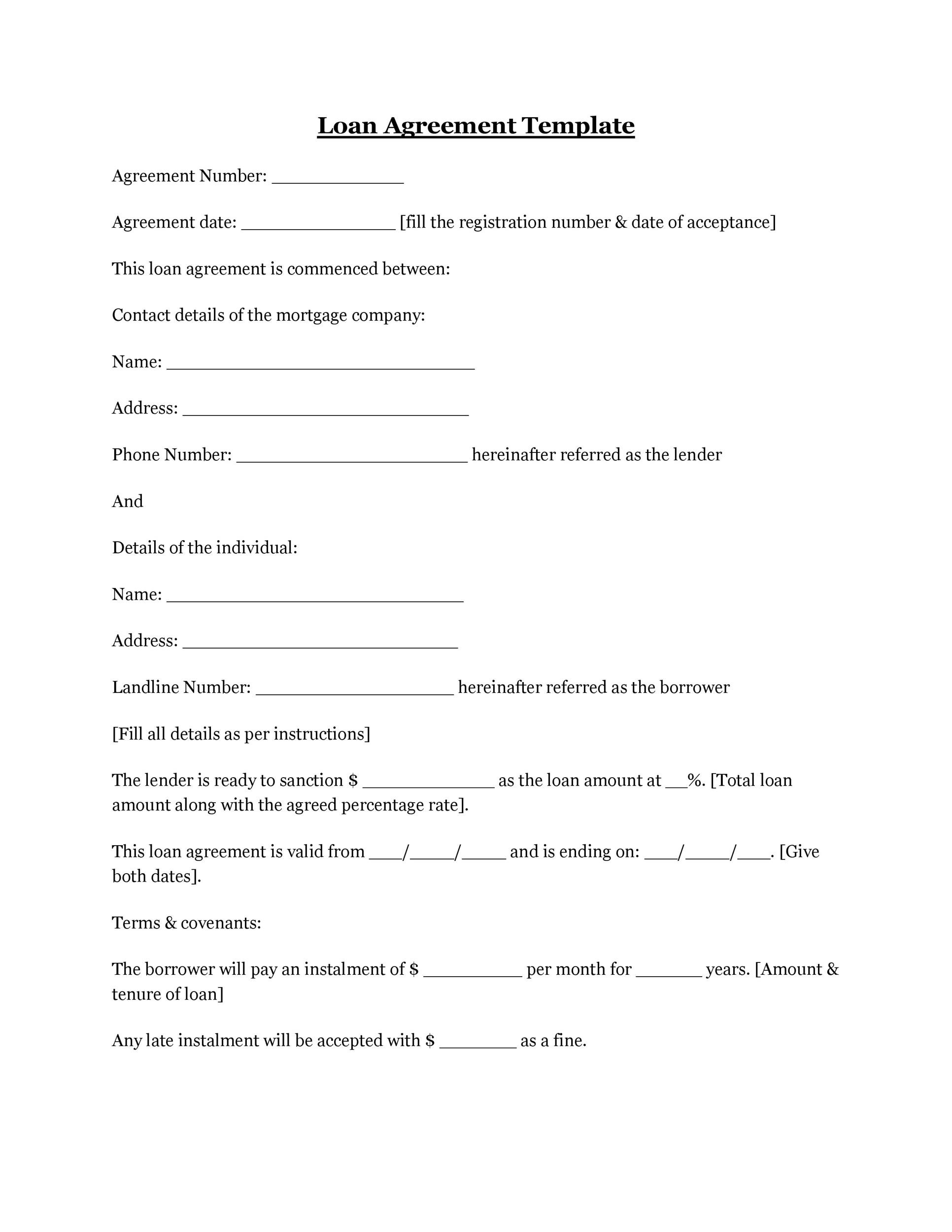

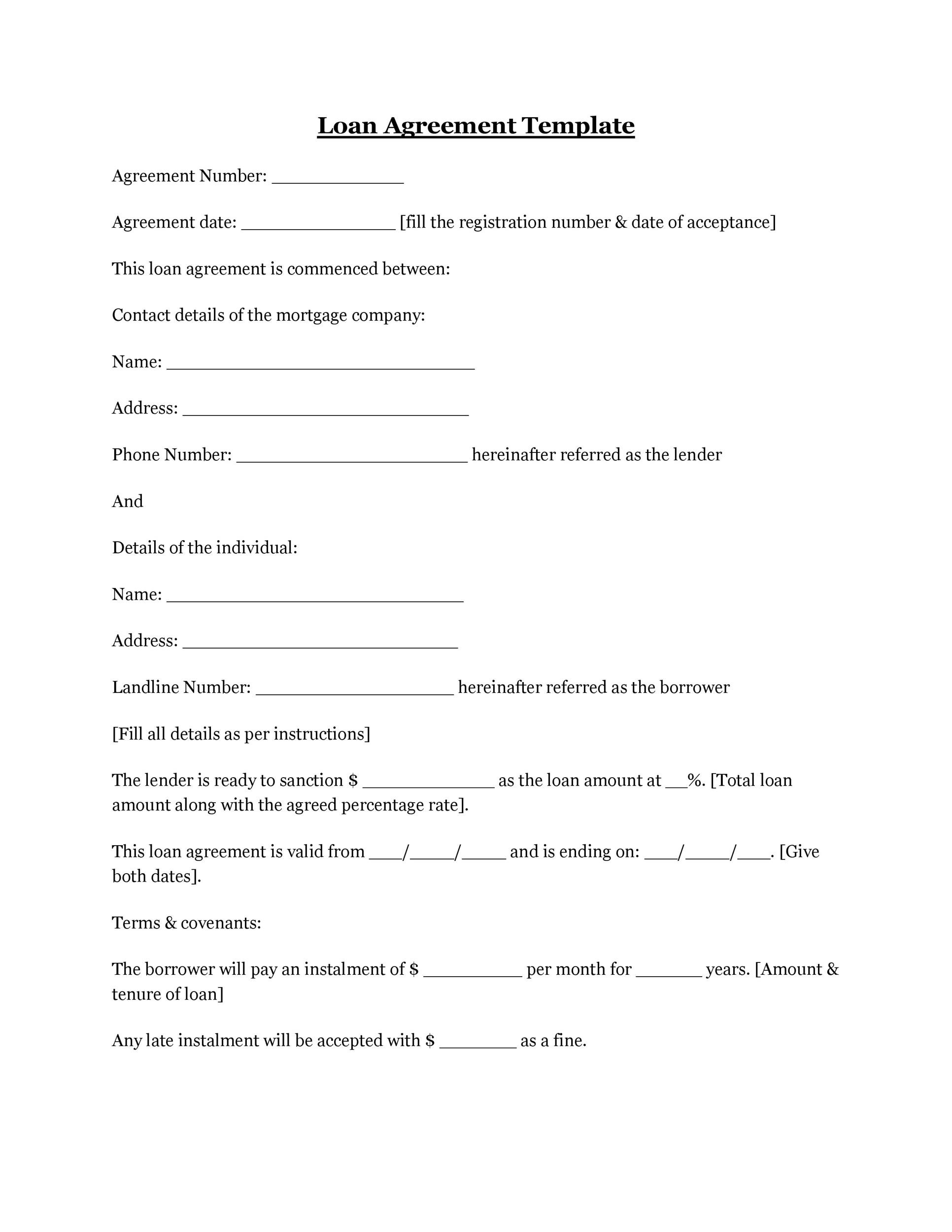

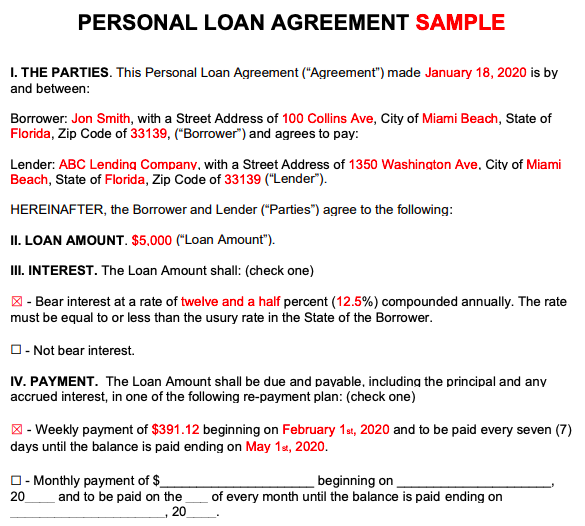

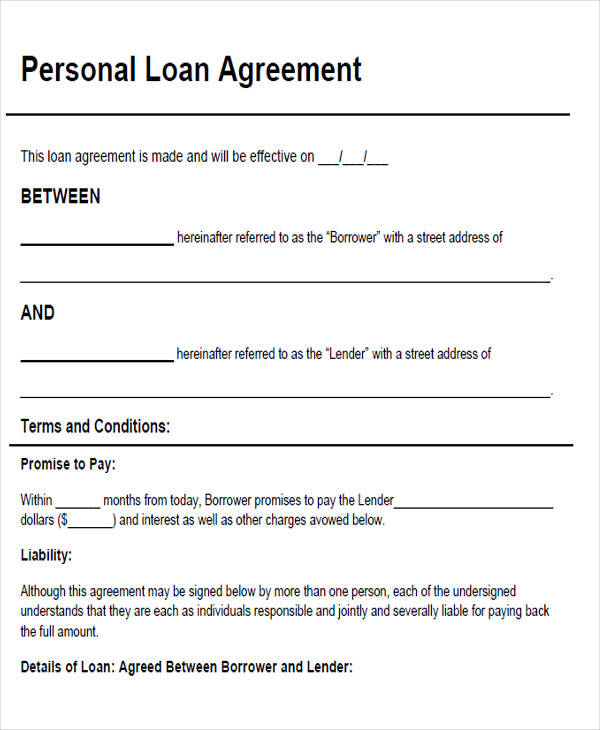

Personal Loan Agreements How To Create This Borrowing Contract

38 Free Loan Agreement Templates Forms Word Pdf

38 Free Loan Agreement Templates Forms Word Pdf

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

38 Free Loan Agreement Templates Forms Word Pdf

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

38 Free Loan Agreement Templates Forms Word Pdf

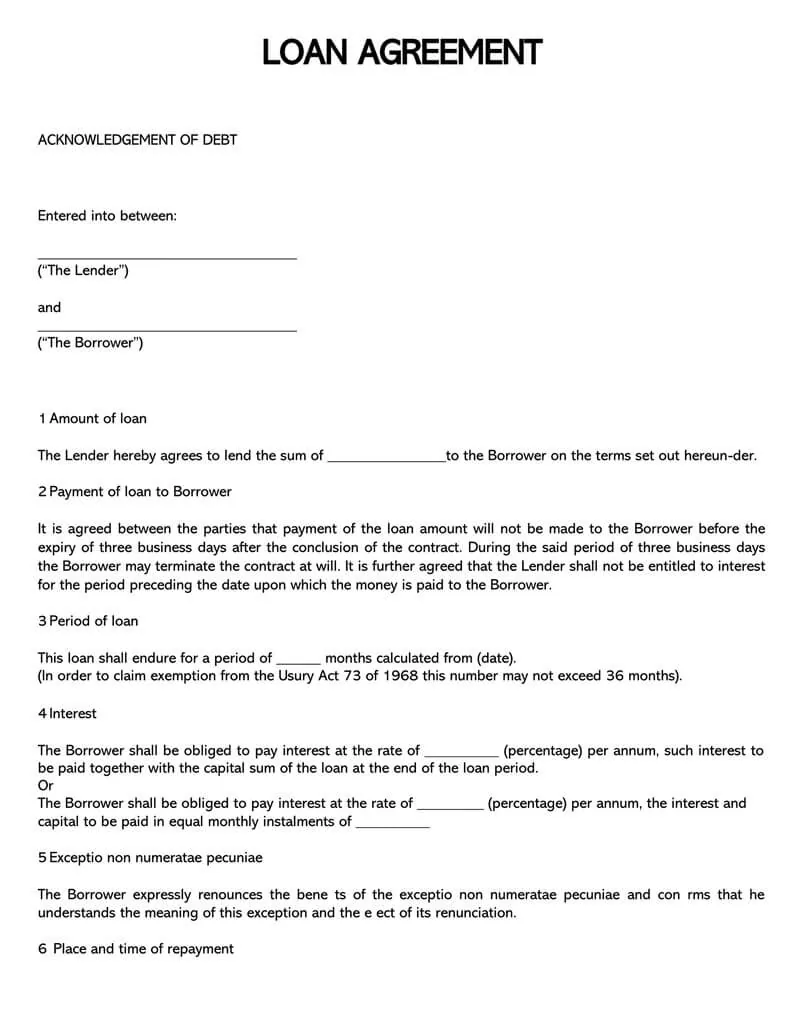

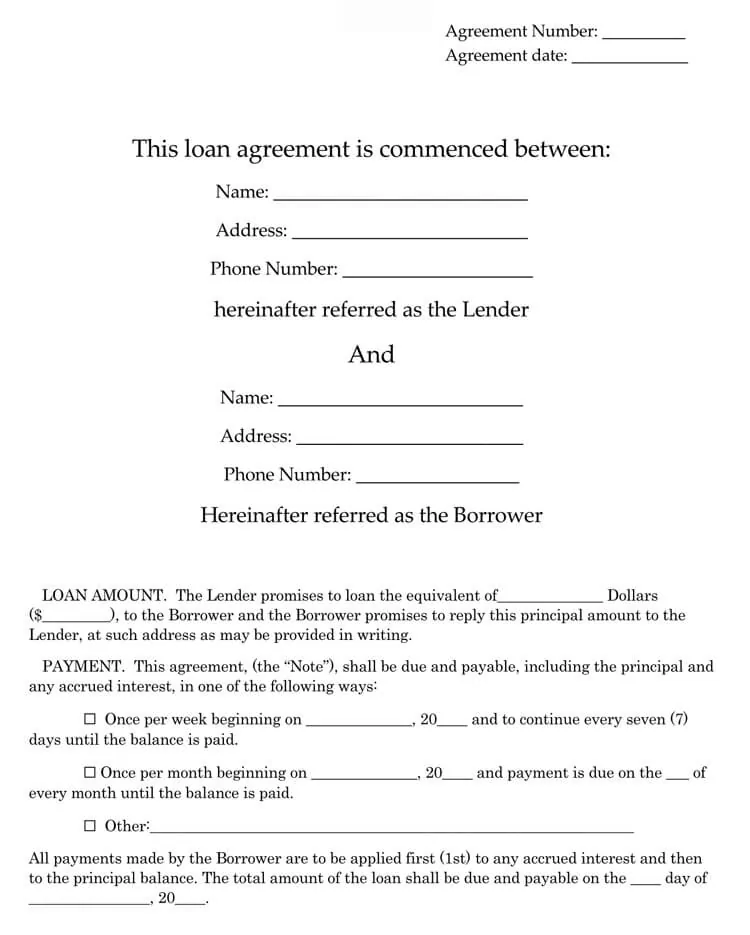

45 Free Loan Agreement Templates Samples Word Pdf

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

Free 46 Agreement Form Samples In Pdf Ms Word

45 Free Loan Agreement Templates Samples Word Pdf

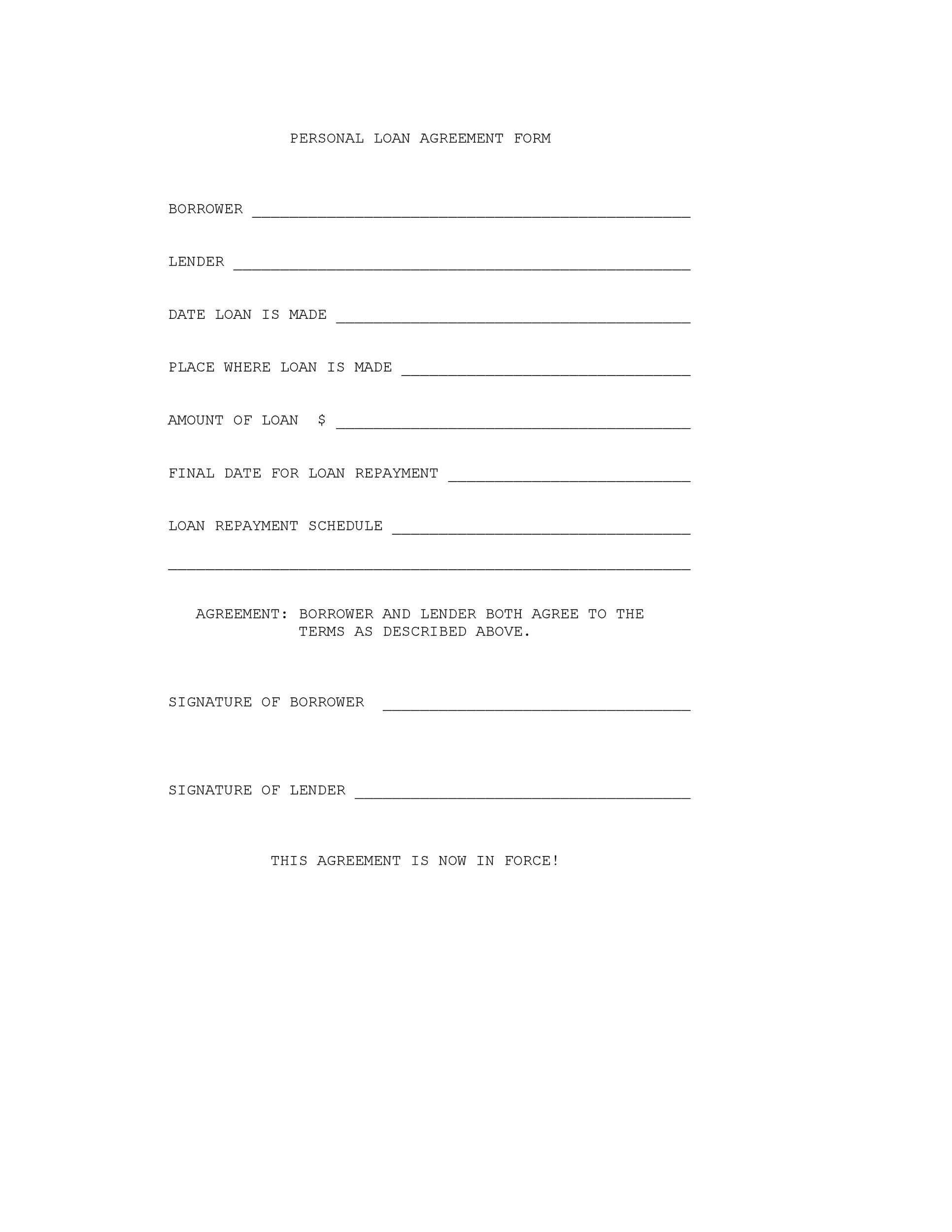

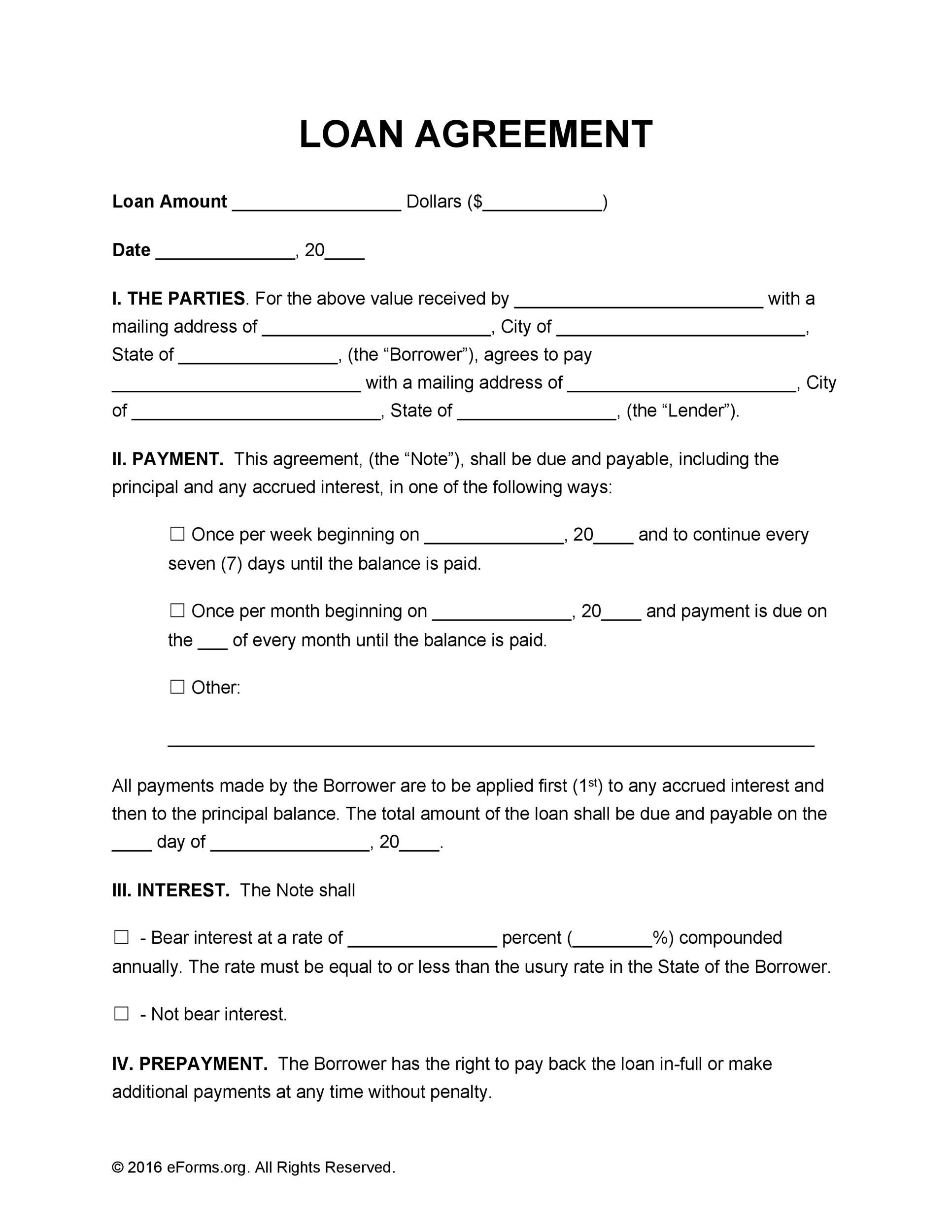

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Payment Agreement 40 Templates Contracts ᐅ Templatelab

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Free Personal Loan Agreement Template Sample Word Pdf Eforms

/GettyImages-917891912-a3aea31808e640578a57ccabd93c055d.jpg)